Nadex 20 Minute Binary Strategy

Thomas has been interested in trading since Oct 5th, 2005. He has been following binary options since 2011 and trading NADEX since 2013.

Go NADEX - Zero Scam, 100% Safe Profits

Binary options take been sweeping the globe ever since the CFTC fabricated allowances for them to be traded in the United states. The thing to take note of is that almost of what y'all will discover when searching online is not what the CFTC intended. Their goal was a regulated, registered, and accountable method through which US citizens and other traders with access to the US market could trade binary options. What they did was create an environment of defoliation in which fraud, scams, and outright theft were able to flourish alongside legitimate trading venues. To this day, despite the many hundreds of "binary options brokers," there are still but three places to trade true, legal, and regulated United states of america binary options and only ane place, actually, for the boilerplate retail trader.

NADEX is the North American Derivatives Exchange and the only binary options trading regulated and safe for US traders. The company is located in Chicago at 311 South Whacker Drive, phone number i-877-776-2339. The biggest difference between NADEX and what I volition call the "off shore" brokers is that NADEX is an exchange. Information technology is a business organisation in performance for the purpose of connecting two traders together. When yous buy or sell at NADEX you are doing and then with another trader. The off shore mode brokers operate like the bucket shops of old. When you make a trade, y'all are actually making a bet with the firm with odds very much like a casino. When you lot lose they win, when you win they lose.

What this ways for traders is conflict of interest. There is a huge disharmonize of involvement when using a financial establishment who makes its money when you lose, they have no reason to see you lot succeed. NADEX has no conflict considering they practise non ever make coin on your losses, only on the traffic of buyers and sellers using the platform. In that sense they have a vested interest in your success, the longer y'all are able to stay actively trading the more money they will make.

What Are Binary Options

Binary options are frequently advertised every bit an easier fashion to trade just this does not make them an easy matter to merchandise successfully. What they are is a highly speculative trading vehicle used for capturing short term movements in an underlying marketplace. Notice that I said speculative trading vehicle, I put it that manner to exist clear about one thing; binary options are very risky and are not to exist considered investments. The life of the merchandise is very brusk and it is possible to lose the entire investment or account in one merchandise.

So, a binary option is a trade on the movement of an underlying asset in which there are only two possible outcomes; max profit or max loss. If you remember the price of the nugget (currency, alphabetize, or article) will go upward you lot buy choice, if you remember the price of the asset will go down yous sell the option, and if the asset toll does as you wait you make a turn a profit. If it doesn't then you lose.

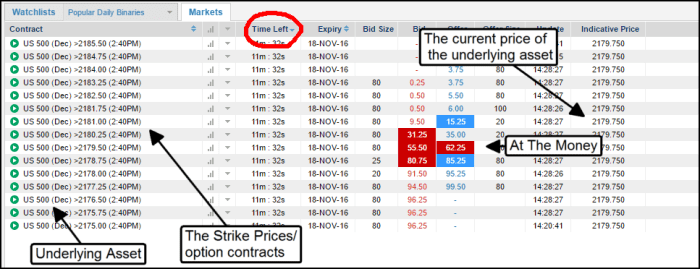

How to trade binary options with NADEX? They list a number of strike prices and death times for each asset that yous can cull from, this listing is called the Ladder. The strikes are sold in lots and referred to as "options," "binaries," or "binary options". The strike price closest to the price of the underlying asset is called "at the money," those below the avails toll are "in the coin" and those above are "out of the coin."

The options will all pay out $100 at decease, if they close in the money. The difference between the max payout, $100, and the cost you pay is your turn a profit. As a point of reference, the at the money strike usually costs $l and pays $50 ($100-$50) in profit at expiration. In the money strikes volition cost more becuase they have a improve chance of closing profitably, out of the money strikes will cost less becuase they accept a lower take chances of closing in the coin.

- My #1 Tip for trading NADEX, when using simple directional strategies, is to only use the At The Coin strike cost for all-time results.

Familiarity with the ladder board is the key to success

The list of NADEX strike prices, called the ladder.

NADEX

NADEX 20 Minute Binary Options

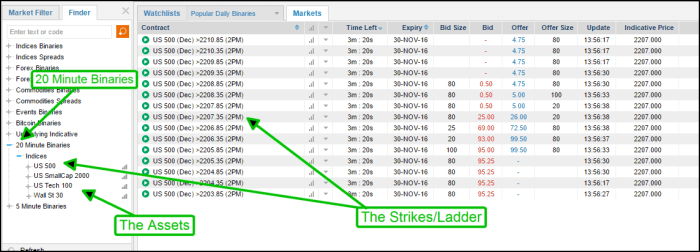

There are a number of unlike death times to choose from, each having its own list of option strike prices. For the purposes of this article I volition focus on the 20 infinitesimal expiry but these techniques can be used with whatsoever expiry NADEX has to offer. They also accept five minute expiry which is OK, simply I recall a little brusk for constructive trading. Besides, these options can exist bought and sold at any time so if the position or trade you want to make is profitable in five minutes or five seconds you tin can cash out. This is another huge advantage over the off-shore style which usually have to be held until expiration.

- At this time in that location are only 4 indices with xx minute expiry, and only 4 assets with 5 infinitesimal expiry but trust me, that is enough. The indices are the four major US indices of which I choose the Southward&P 500 as height selection, listed on the NADEX platform as the U.s.a. 500.

twenty minute expiry means that each pick exists for only xx minutes. Unlike off-shore style binary options which would last for 20 minutes subsequently the fourth dimension of purchase, NADEX xx minute options outset and stop every twenty minutes, that is, every twenty minutes a new choice with a total list of strikes becomes available and xx minutes subsequently it expires. During the life of the option you can open up and shut a position at whatever time you want. If you lot open one immediately it will have very near to xx minutes until expiry, if yous wait 10 minutes to open a position the pick will have 10 minutes left until expiry.

Scroll to Keep

Read More From Toughnickel

20 infinitesimal binaries are listed by strike for a number of major stock indices.

NADEX.com

The Allure Of Binary Options

Buying and Selling at NADEX Binary Options Exchange

Some other attribute of trading NADEX that can be off-putting to new traders is the purchase/sell nature of the options. I've already discussed how these options tin can bought and sold at any fourth dimension during the life of the option only this concept is deeper even than that. NADEX options are bought and sold to open up, and bought and sold to shut, depending on how yo want to position yourself. This is different from off shore EU style options in two means. First, off shore style options are only bought. If you are bullish you buy a call, if y'all are bearish you buy a put. The second is that In both cases yous give money to the broker in hopes of a pay out, this is non true at NADEX.

In order to facilitate the exchange nature of NADEX, the ability of traders to buy and sell with each other, NADEX options are traded in lots. If you are bullish and retrieve that the assets price will close above a set strike, you buy to open. This opens a long, or bullish, position like to owning a call. You lot pay the asking cost and profit when the option expires and yields the max payout. If yous desire to shut your long position before expiry, you volition accept to sell to shut.

The confusion comes in when traders want to open up a surly position. When trading a lot, if yous are bearish, yous volition sell to open. This means that yous sell a position to another trader, receiving a credit for the BID toll, the toll at which they were willing to buy, and get to keep that credit if the pick strike expires out of the money. If you lot want to close your brusk, or put, position you volition demand to buy to close.

Risk is the last gene to sympathise. When yous are buying calls and puts at an offshore broker your risk is ever the amount you pay for the option. At NADEX when yous Buy To Open up your adventure is what y'all pay for the choice, if it closes out of the money then y'all could lose information technology all, only when you sell to open your chance is much different. If the option yous sell happens to close in the money, you are responsible for paying the max return of $100 to the trader who bought the option. This does not mean your risk is $100 considering you received a credit, in the end your chance is the max payout minus the credit you received.

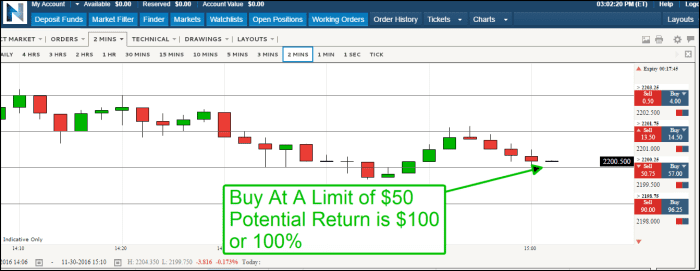

A Trade Example Using the 20 Minute Expiry

In this instance, I utilise the 20 minute death and am looking to open up a merchandise every bit soon as the next 20 minute decease becomes available, so that the merchandise will take the full 20 minutes. Information technology is possible to wait and enter the trade at whatsoever time, at whatsoever strike, upward to and until the pick expires. In this instance the asset existence traded is the S&P 500, known as the Usa 500 on the NADEX platform, and it has been trending sideways on the 2 minute chart. Nugget cost is holding near 2200, a level that could be back up. The closest strike is the 2200.25, what we volition call at the coin, and is trading for just over $fifty. I will utilise a limit social club to purchase to open 1 lot at $50 to endeavour and get a adept fill price. If the choice closes above my strike,and I get a fill up, then I volition profit $fifty, or 100%.

- I like to trade off the charts provided on the platform. They are adjustable, include mutual trading tools and listing the available strikes to the right of the screen. To trade, simply click the strike you want to buy or sell and an order box will pop upwardly.

Employ limit orders to get the all-time fill prices.

NADEX.com

Closing the Trade at a Profit

Presently after opening the above trade asset price pulled back beneath the strike I was targeting, allowing me to get an entry of $50. After a few minutes of consolidation the index bounced back and made a stiff motion to the upside, putting my strike firmly in the money and showing a nice profit. I chose to sell early, at $94.50, for a internet return of 89.five%. Nugget price remained at the new highs until death so if I had held it I would have made the full return.

NADEX.com/Own Work

The Cost of Trading at NADEX

In that location is of class a cost, NADEX is a business after all. The good news, and something I striking on earlier, is that NADEX does not make money when you lose. That is, yous are non betting with the house like y'all practice with a casino and similar yous practice with the offshore manner brokers. NADEX charges a small fee, $0.90 per lot, for each lot that y'all purchase and sell. If you buy to open and sell to shut one lot yous will incur a charge of $i.80. If you buy to open and concur to expiry and the strike closes in the money it will cost you lot $1.80 too simply is you the choice expires out of the money there is no charge to shut. At that place is a limit to how much you tin be charged and that is $nine.00 per trade, or 10 lots.

This article is accurate and true to the best of the author'due south knowledge. Content is for informational or entertainment purposes only and does not substitute for personal counsel or professional communication in business, financial, legal, or technical matters.

© 2016 TMHughes

Chargeback Scams on May 22, 2020:

Prissy Share First Option Recovery, being experts in the field of fund recovery have had a presence in over 22 countries regarding such issues. With a team of 120+ attorneys and a decade of experience backing them, we are hell-aptitude on eradicating chargeback scams across the earth

Nadex 20 Minute Binary Strategy,

Source: https://toughnickel.com/personal-finance/How-To-Trade-NADEX-20-Minute-Binary-Options#:~:text=Unlike%20off%2Dshore%20style%20binary,20%20minutes%20later%20it%20expires.

Posted by: taylorexis1974.blogspot.com

0 Response to "Nadex 20 Minute Binary Strategy"

Post a Comment