How Much Is A Standard Lot Forex

0.01 Lot Size in Forex trading (also known as Micro Lot) equals 1.000 units of whatsoever given currency. In any forex pair where the quote currency is the USD such equally the GBP/USD, the pip value per Micro Lot is $0.1.

If you're trading a Micro lot of GBP/USD and the price moves 50 Pips in your favour and then to calculate your profit, multiply 50 pips times $0.one, the result is a profit of $5.

Understanding Lot Sizes is the key to efficient trading as you'll be able to decide your chance-reward ratios and your costs equally well. A practiced example of this would exist:

- Suppose that there is a currency pair that only moves 1 Pip a week

- If in this imaginary trade, your Pip Value per Lot size is $5 and the spread your broker charges is 5 Pips, at that place is no way to be profitable

- Every fourth dimension you open a i Lot trade, you're paying $50 in commissions and based on this imaginary case, your best odds (due to the wearisome currency pair price variation) is making $v a week

Run across how it makes sense? Well, time to continue reading then you can acquire how to improve your forex trading and which low spreads forex brokers tin greatly improve your cost efficiency.

Featured Depression Spreads Forex Brokers

| Banker | EUR/USD Spread |

|---|---|

| Visit 74-89% of retail CFD accounts lose coin | Dynamic - From 0 to 0.six Pips |

| Visit 63.two% of retail CFD accounts lose money. | Dynamic - From 0 to 1.2 Pips |

| Visit 74-89% of retail CFD accounts lose money | Dynamic - From 0.eight Pips |

| Visit 77% of retail CFD accounts lose money | Dynamic - From 0 to 0.viii Pips |

| Visit 75.26% of retail CFD accounts lose money. Trading on margin is high gamble and is not suitable for everyone. | Dynamic - From 0.eight Pips |

Forex Lot Sizes Basics

A standard lot in Forex trading equals 100.000 units of whatsoever given currency, to go far at the adding of how much is 0.01 Lot all nosotros need to practise is multiply 0.01 times 100.000, the result is 1.000.

The most mutual types of Lot sizes in Forex are:

- Standard Lot - 100.000 units

- Mini Lot - x.000 units

- Micro Lot - 1.000 units

- Nano Lot - 100 units

Equally we understood a Mini lot is worth 1.000 units of any given currency which can as well exist referred to as 0.01 lot in forex. So if we buy 0.01 lots of EUR/USD that means that nosotros purchased €1.000 worth of USD.

Pip Value per Lot Size

So far we described the pip value per micro lot (0.01 lot) using forex pairs where the quote (secondary currency) is the USD.

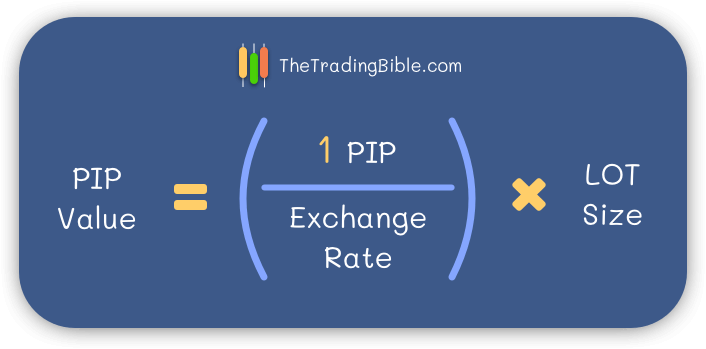

In case you're wondering how to calculate the pip value per lot size when there are different currency combinations where the USD is not the quote, you tin can use the following formula:

Explaining the formula:

- one PIP: in here y'all insert the value of the pip for the currency pair yous're trading, in most cases it's 0.0001, in the case of the USD/JPY is 0.01)

- Exchange Rate: current price of your currency pair

- Lot size: the actual number of currency units depending on your lot size, for instance: 100.000, 10.000, 1.000, 100

The results of the Pip value per Lot size formula always come expressed in terms of the base currency which then you lot can convert into the currency of your pick (commonly everyone converts to USD), the only moment where you don't need to practise this conversion is if the pair has the USD as base (starting time currency) , as the issue of the formula comes expressed in terms of the base of operations.

Remember, when the currency pair has the USD as secondary currency, yous don't demand to do the formula, yous already know that:

- PIP Value per Standard lot on pairs with USD as quote: $ten

- PIP Value per Mini lot on pairs with USD as quote: $i

- PIP Value per Micro lot on pairs with USD as quote: $0.i

- PIP Value per Nano lot on pairs with USD as quote: $0.01

For all others, use the formula and you'll exist able to calculate your pip value per lot size regardless of the currency pair you're trading.

If y'all want to learn more virtually this field of study experience free to read our full guide on Pip value per Lot Sizes where we explain everything about each lot size along with some good frequently asked questions.

Below you'll observe the spreads charged past some of our favourite brokers. This will help you lot understand how much majuscule tin y'all salve during your trades. To give you a good thought, if a broker charges a spread of 5 Pips on EUR/USD, you'll be spending $50 every fourth dimension you trade 1 Lot. This is definitely an of import figure to keep in mind to ensure that your trading plan is met and you lot don't end up spending all your trading upper-case letter in commissions.

Source: https://thetradingbible.com/how-much-is-0-01-lot-size-in-forex-trading

Posted by: taylorexis1974.blogspot.com

0 Response to "How Much Is A Standard Lot Forex"

Post a Comment